Among those who are on Medicare (which entails folks over the age of 65 and younger adults that have long-term disabilities, having received Social Security disability benefits for over 24 months), many of them have a form of diabetes. That number as of 2017, hovered around one-third (33%), having increased from 18% in 2000.

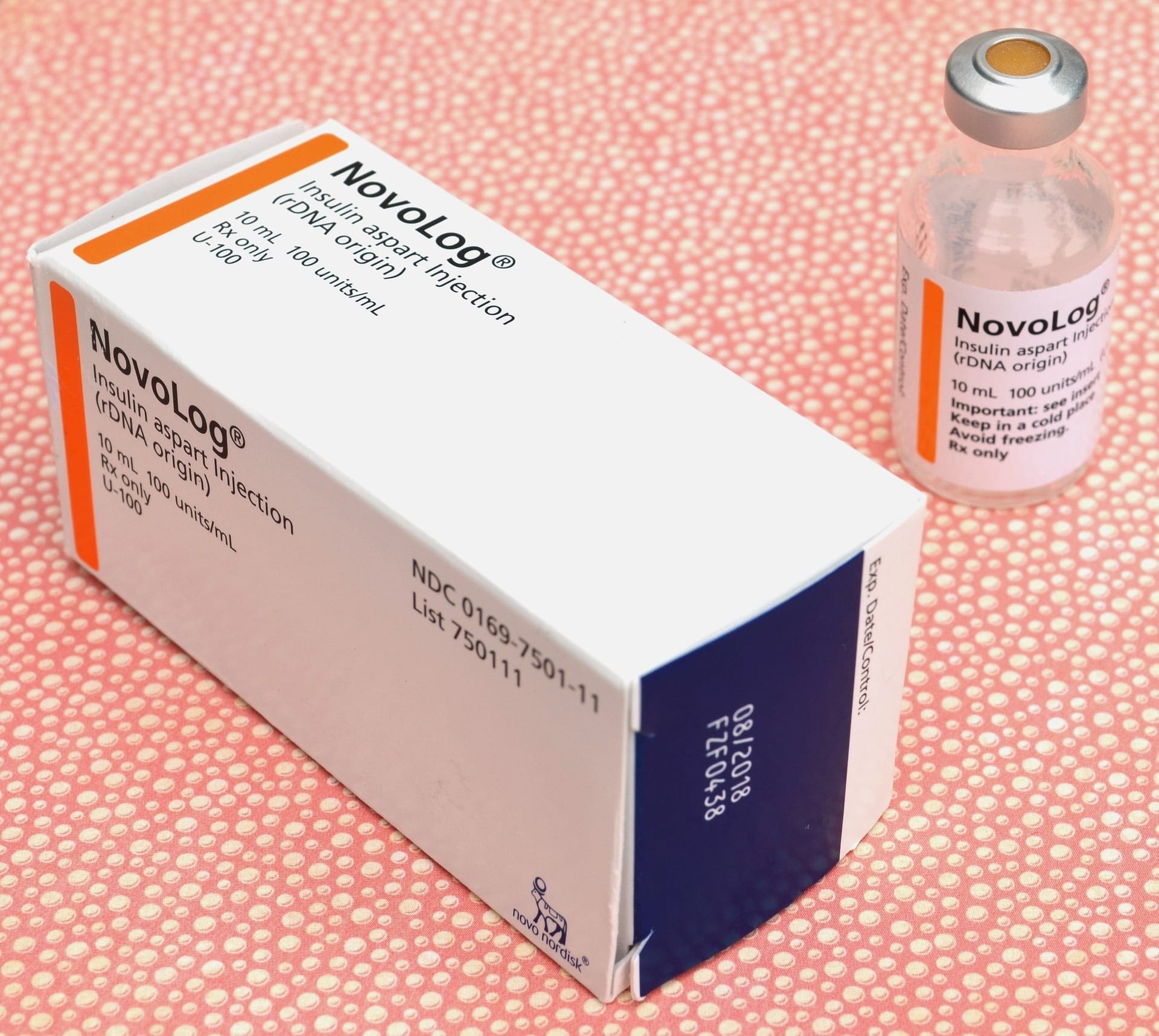

For those unfamiliar with the medical condition of diabetes, in short, it is a disease that occurs when one’s blood glucose (blood sugar) is too high. Blood glucose is our main source of energy and comes from the foods we eat. Where insulin (a hormone made by the pancreas) comes into play, is that it helps the glucose from food get into your cells to be then used for energy. But for some diabetics, our body doesn’t make enough (or any) insulin, which results in glucose staying in the blood and not reaching our cells.

We here in Texas meet lots of folks who are on Medicare and many have limited incomes, so sometimes having to decide between getting groceries that week or refilling the insulin they desperately need becomes a hard choice to make. For those unaware, Original Medicare does not cover non-insulin pumps, pens, syringes, and other key medical supplies for diabetics. If one is fortunate enough to have a Medicare Advantage plan or Medicare prescription drug plan (Part D), then you are in better shape but insulin can still be costly. From our experience, it was usually at least $47 a month or more for a 30-day supply, or many times dependent on the brand, not covered by the insurance company. And if one thinks GoodRx or a drug manufacturer assistance program would have helped, in many cases, GoodRx had the costs near retail (very expensive) and drug assistance programs did not allow those on federal programs like Medicare, to get help.

Thankfully, in May 2020, the Trump Administration announced major reform in the way of addressing the out-of-pocket costs of insulin products for Medicare enrollees. Notably, over 1,750 stand-alone Medicare prescription drug plans (Part D) and Medicare Advantage plans have applied to lower insulin costs through the Part D Senior Savings Model for the 2021 plan year. What this means is that Medicare beneficiaries will now have access to a broad array of insulin medications at a maximum of a $35 copay for a one month’s supply, from the beginning of the year through the Part D coverage gap. The savings folks on Medicare should see from this initiative from the White House, will be an average out-of-pocket savings of $446 or 66% for their insulins, which is funded in part by the drug manufacturers paying an additional $250 million worth of discounts, over a five-year period.

As the Kaiser Family Foundation (KFF) pointed out in June 2020, many Medicare Advantage plans/Medicare prescription drug plans (Part D) had insulin as a Tier 3 on the formulary (typically $47 copay) during the initial coverage phase, but once folks hit the coverage gap phase, folks faced a 25% co-insurance which equated to over $100 or more per prescription. So having a flat $35 copay is a big improvement.

See below for a recap from CMS ⇓

Keep in mind that not all insulin products have to be covered by participating Medicare Advantage plans/Medicare prescription drug plans (Part D), so it is imperative to double check the insulin you take will be covered prior to enrolling in a plan during Open Enrollment. That’s where we come in at The Harrin Group. If we can ever be of assistance to you or anyone in your family needing a quality Medicare plan that will address your insulin needs here in Texas, Florida or California, we are here for you! Contact us for a free, no obligation analysis of your situation today!

Be sure to like us on Facebook as well below⇓

Sources: National Institute of Diabetes and Digestive and Kidney Diseases, Medicare.gov, GoodRx, Center for Medicare & Medicaid Services (CMS), Kaiser Family Foundation (KFF)