Quick Links

What Are Some Of The Biggest Retirement Mistakes?

“The question isn’t at what age I want to retire, it’s at what income.” — George Foreman

It seems that our government and politicians have a lot in common with Count Dracula. Both suck the life out of their victims. One removes all your blood and the other removes as much of your money as they can get away with, by redistributing your hard-earned savings … in the form of taxes.

Please understand that taxes can make or break your retirement. If you believe as most other Americans that taxes will be going up and you’re terrified that your safety net of Social Security and Medicare won’t be around for you, then let us help you build your own safety net to protect yourself and your family … so that you never run out of money in retirement.

One of the tactics used by our government, politicians, bankers, and Wall Street to confuse you and the rest of the middle class, is their use of a strange, made-up financial language. It is a confusing alphabet soup of terminology and language such as 401(k), IRA, qualified plan, non-qualified plan, etc. If you are not familiar with any of this made-up language, you’re at a distinct disadvantage.

It would be like someone from San Antonio, Texas moving to France and never learning to speak French, but expecting to be successful living there. Makes no sense, right? So, before we get into the specific investments, let’s work together to get you a little more fluent in the language of money … your retirement money and then work on finding the right retirement solutions, for you and your family.

There are two common terms you will hear and read in any financial discussion regarding retirement. These two terms are “qualified” and “non-qualified” retirement plans.

What Is A Qualified Retirement Plan?

Qualified retirement plans meet all the rules and stipulations of the Internal Revenue Service (IRS) code to allow for tax-deferred contributions. Such plans are governed by the Employee Retirement Income Security Act (ERISA) of 1974. When it comes from the employer’s standpoint, facets such as employee participation, operations, compensation limits, deferral limits, and contribution limits are all things that must be strictly adhered to. The plus side for an employer offering such options can be tax deductions, assets in the plan grow tax-free, and such plans make employers more attractive to employees.

For the employees, such plans offer convenience (automatically deducted from paycheck), immediate tax break with tax-deferred contributions, assets grow tax-deferred, the potential for matching contributions on behalf of your employer, diverse investments, and protection from creditors (generally safe from collection actions due to ERISA).

The Internal Revenue Service (IRS) offers a guide to the common qualified plan requirements, which you can find here.

Typical Qualified Retirement Plans:

- Defined benefit plans, such as pensions

- Defined contribution plans, such as the 401(k), safe harbor 401(k), SIMPLE 401 (k), a solo 401 (k), profit sharing plans, and money purchase plans

- Employee stock ownership plans (ESOP’s)

- Keogh plans or H.R. 10 plans, that are terms for qualified retirement plans that are set up by you, unless you are self-employed

What Is A Non-Qualified Retirement Plan?

Non-qualified retirement plans are a type of employer-sponsored retirement plan that fall outside of the ERISA requirements. They are essentially designed to meet the needs of key executives or select employees, via recruitment or employee retention tools. For the employer, these types of plans are not eligible for tax deductions. Employees can enjoy no limitations on contributions, but keep in mind any of your deducted contributions for non-qualified plans are taxed like your regular income.

Typical Non-Qualified Retirement Plans:

- Deferred compensation plans

- Executive bonus plans

- Group carve-out plans

- Split-dollar life insurance plans

Qualified Retirement Plans Versus Non-Qualified Retirement Plans:

When it comes to eligibility, qualified retirement plans must be made available to all employees, while non-qualified retirement plans can be made to select employees such as an executive. With compensation deferral limits, total dollar limits are adjusted each year by the IRS for qualified retirement plans, while non-qualified retirement plans have no defined IRS limits. Distribution timing differs between the two plans, with qualified retirement plans generally not allowing distributions before the age 59 1/2, except in the case for financial hardship, while non-qualified retirement plans have several options but once a distribution option is selected, it can’t be changed. With mandatory distributions, required minimum distributions (RMD’s) start at age 70 1/2 for qualified retirement plans, while they are not required by the IRS with a non-qualified retirement plan. Lastly, assets are protected from company creditors with a qualified retirement plan, and are not protected with a non-qualified retirement plan.

Key Definitions:

401(k): The 401(k) is, without any doubt, the granddaddy of all qualified retirement vehicles. Unfortunately for most Americans whether here in San Antonio, Texas or beyond, this is the beginning and sadly the end of their savings strategy. A 401(k) refers to the tax code and is a provision in the tax code for employees that allows you to have tax-deductible and tax-deferred savings. If you are lucky, your employer can match a certain percentage of your contribution … which is a very good thing.

457 plan: is a similar provision in the tax code for government employees, while the 403(b) plan is for employees of non-profits such as colleges, schools, and charities. These operate in a similar manner as the 401(k).

Individual retirement account (IRA): can be used in addition to the other qualified plans providing another place to put money, in your choice of investments that are also tax deductible and tax-deferred.

Note: Although the Roth IRA is similar to the Traditional IRA, your money deposited is not tax deductible; however, unlike the other IRA’s, your money can be withdrawn tax-free (but only by you … not your beneficiaries).

Simplified employee pension (SEP): This is a provision in the tax code for a small-business person or sole proprietor and is similar to a 401(k) but without any percentage matching.

Medical savings account (MSA): This is another provision in the tax code that allows you to put money away for medical expenses. It is similar to the IRA, but it allows tax-free withdrawals for medical expenses only.

Certificate of deposit (CD): We prefer to call them “certificates of depreciation.” They are generally offered by banks or credit unions. The monies are insured up to $250,000 by the Federal Deposit Insurance Corporation (FDIC). The CD’s require you to maintain your monies in the account for a contractual period, generally six months to five years in return for a guaranteed interest rate that is usually very low. Early withdrawal will trigger financial penalties.

Stocks: This is a type of security that gives you some ownership in a corporation and gives you a claim for a portion of the corporation’s assets and earnings. Common outlets to purchase stocks could be via a stockbroker such as Fidelity, TD Ameritrade, and Robinhood.

Mutual funds: Mutual funds are several stocks bundled together and usually chosen by professional fund managers. They are designed to outperform the Standard and Poor’s (S&P) composite of the 500 largest companies publicly traded.

Bonds: This is a debt investment in which you loan money to an entity (corporate or governmental) for a set period of time at a set interest rate. These bonds are commonly used by companies and governments (foreign, U.S. federal, state and local) to pay for various projects and activities.

Annuities: An annuity is a contract between you and an insurance company to invest money with that company. Your investment can either be in a lump sum or in a series of payments. In return for your investment, you can receive a regular payment (generally with interest) beginning immediately or at some point in the future. These payments to you can be guaranteed for life even if you ran out of money. See our annuity page for more details.

Life insurance: This is a protection against loss of income that would result if the person insured, were to pass away during the life of an insurance contract. Upon the death of the insured, the beneficiary you chose would receive the proceeds of the insurance policy, thereby safeguarding the beneficiary from the financial impact of the death of the person insured. See our life insurance page for more details … especially the IUL section.

Now that we have provided you with a basic understanding and some fluency in the language of money, it’s time to move on to the biggest retirement mistakes many people make. ⇓

Retirement Mistakes:

Mistake #1: The first and single biggest mistake people make is not taking the time to educate themselves regarding their own finances.

The reason self-education is necessary, is because there are too many conflicting and confusing theories about handling your finances. However, we are not suggesting that you need to know every term to understand the basic principles related to a successful retirement plan.

Mistake #2: Not paying yourself first.

A book by George Samuel Clason called The Richest Man in Babylon written in 1926 said it best: “A part of all you earn, is yours to keep.”

Mistake #3: The failure to understand how much taxation, interest, and inflation will affect your future financial plans.

We have gone to great lengths to gather substantive, credible and verifiable information that will help you understand that most of your financial gains going forward, will come from tax avoidance. Louis D. Brandeis was a famous United States Supreme Court Justice from 1916 to 1939. The following are some of his fascinating thoughts on tax avoidance:

“I lived in Alexandria, Virginia. Near the Supreme Court chambers is a toll bridge across the Potomac. When in a rush, I pay the toll and get home early. However, I usually drive outside the downtown section of the city and cross the Potomac on a free bridge. The bridge was placed outside the downtown Washington, D.C. area to serve a useful social service: getting drivers to drive an extra mile to help alleviate congestion during rush hour.”

“If I went over the toll bridge and through the barrier without paying the toll, I would be committing tax evasion. If, however, I drive the extra mile outside the city of Washington and take the free bridge, I am using a legitimate, logical and suitable method of tax avoidance, and I am performing a useful social service by doing so.”

“For my tax evasion, I should be punished … For my tax avoidance, I should be commended.”

“The tragedy of life is that so few people know that the free bridge even exists.”

Mistake #4: Commingling your savings and investments.

Many Americans frequently do this during difficult economic times (ie. COVID-19) and this is one of the primary reasons they don’t have sufficient funds at retirement age … a time when they need these funds the most. Again, it makes no sense to put your savings in an inaccessible place, like a qualified plan, where you can’t use your money … just when you need it most.

Mistake #5: Not seeking professional assistance.

You should never risk your future retirement by trying to do it all yourself or on the Internet any more than you would do your own dental work, or your own surgical procedures. Doing it yourself is probably more effective for maintaining your home or car, than your retirement.

Mistake #6: Not taking advantage of the POWER of compound interest, tax deferral, and tax-free distributions.

This rule alone, is the most important to understand and apply. Albert Einstein once said “Compounding is mankind’s greatest invention because it allows for the reliable, systematic accumulation of wealth.”

Mistake #7: Using inflexible plans such as IRA’s and 401(k)’s as your primary savings and retirement plan.

Plans that penalize you for the use of your own money come to mind. Those plans that do not anticipate the unexpected, are the most dangerous. Remember, the best laid plans of mice and men, often go astray.

Key Points To Remember:

- The granddaddy and most popular type of qualified plan is a 401(k).

- The most popular types of non-qualified plans are CD’s and annuities.

- Investment vehicles can either be qualified or non-qualified and can be subject to risk of loss of your principal or investment.

- Lack of education will tax you the greatest.

- Pay yourself first.

- Don’t underestimate your true taxation.

- Don’t commingle savings and investments.

- Seek professional assistance.

- Use the power of compound interest.

- Create a flexible plan for multiple contingencies.

Since we want to keep this section to a reasonable length, here are the key points for what we consider the rock-solid foundation for your future retirement plan (annuities and IUL’s), IN ADDITION to any 401(k) or IRA.

Key Points For Annuities:

- The annuity’s primary purpose is to provide a guaranteed stream of income.

- Annuities do not require you to be in great health.

- Annuities are often used to roll over funds from a 401(k) account to avoid a taxable event.

- Some indexed annuities provide income riders that guarantee future streams of income, regardless of market performance.

- The proceeds of your annuity contract could potentially be protected from attachment, garnishment, or legal process, in favor of creditors in bankruptcy or legal judgment and can avoid all the red tape of probate court upon your death.

- Annuities can be used as qualified retirement vehicles.

- Annuities can also have high fees and commissions, which is why you need an independent insurance agency to shop around all the top-rated insurance companies for you whether here in San Antonio, Texas or elsewhere we operate.

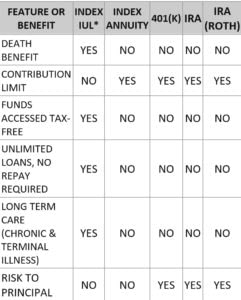

Key Points For Indexed Universal Life (IUL) Insurance:

- The IUL unlike your 401(k), IRA, CD or annuity, has a built-in death benefit that passes tax-free money to your beneficiary.

- A properly structured IUL can achieve a large annual cash accumulation with a cap of 10 percent or more, and a zero percent floor, meaning both your principal AND your gains are never at risk.

- Some IUL’s include a living benefit such as terminal illness, critical illness and chronic illness that can provide for your long-term care (LTC) type expenses … without paying hundreds a month for a separate policy.

- A properly structured IUL plan can potentially be protected from attachment, garnishment, or legal process in favor of creditors in bankruptcy or legal judgment and can avoid all the red tape of probate court upon your death.

- A properly structured IUL is one of the best retirement savings vehicles for accumulating retirement cash and reducing taxes.

OK, Folks, Here Is A Summary Of All The Retirement Solutions In One Place:

Here is a short but critical video you must see (5 minutes) from the renowned CPA: Ed Slott. He is one of the foremost experts in the United States on both IRA’s and taxes, and this information is critical for your future.

At this point, you may be thinking that the indexed universal life (IUL) insurance policy sounds too good to be true, and you may be wondering, why isn’t everybody doing it, if it’s so great? Well, that’s a very fair question and you deserve an answer, so here goes.

Many of the media gurus and financial planners don’t get very excited over the thought of any life insurance product as a retirement vehicle. There are a few reasons for this, such as; it’s just not sexy enough or they refuse to spend the necessary time to become fully educated regarding the power of this vehicle, or in the case of financial advisors and life insurance agents, to put it bluntly … they don’t like the smaller commissions.

So the bottom line is if you or your children are able to qualify for life insurance, this is a great way to build your own pension/disability plan, with certain annuities being a close second. Since everyone’s situation is unique and special, don’t wait or hesitate … contact us for a FREE, no obligation custom analysis, so we can help find you the right, retirement solutions. Whether you are here in San Antonio, Texas, or Los Angeles, California, we are here to help you.

Sources: George Foreman, DOL.gov, IRS.gov, FDIC.gov, George Clason/Wikipedia, Louis Brandeis, Albert Einstein, The Balance, Investopedia, Aaron Arnold/Ed Slott CPA